how to read td ameritrade tax documents

For Interactive Brokers comparison based on customers trading less than 10000 contracts a month with. Tax filingfact or myth.

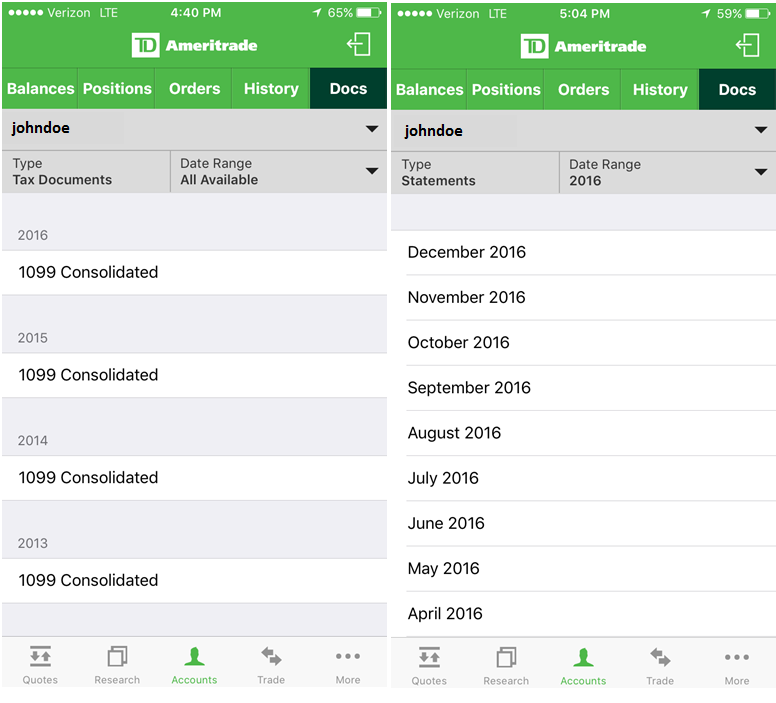

Get Real Time Tax Document Alerts Ticker Tape

By offering the same features as the mobile or web-app version youll get access to.

. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc and The Toronto-Dominion Bank. In recent years tax-free savings accounts TFSAs have grown in popularity. Your brokerage accounts 1099 form for 2021 must be in the mail by January 31 2022.

The custodian of your account TD Ameritrade Clearing Inc is a member of the Securities Investor Protection Corporation SIPC. In addition with some of our requests state income tax was withheld but not with others - Tds doing not ours. Stocks options if approved mutual funds exchange-traded funds ETFs bonds and CDs are available in most TD Ameritrade accounts.

ETFs are not guaranteed their values change frequently and past performance may not be repeated. Account funding must be completed in order for trading to begin. TD Ameritrade offers over commission free ETFs from industry giants iShares Vanguard and more.

The developers want you to read and monitor your account at any time of the day. The tax on a major purchase however can be added to the table amount so keep those receipts. You are urged to consult your tax advisor concerning the application of US.

Select the TD Ameritrade account thats right for you. There are three 1040 tax return forms. Get a clear view of both the market and personal portfolio performance with this simple straightforward and easy to use app on your phone tablet or Apple Watch.

Learn more about TD Direct Investing How to invest with a TFSA. Access all the essentials you need to manage your accounts wherever you are with the TD Ameritrade Mobile App. Thats right a consolidated 1099 form should be postmarked by February 15 2022 according to the Internal Revenue Service IRS unless firms file for an extensionFirms that file for Client Tax Form extension will have until March 15 2022 to.

ETF units are bought and sold at market price on a stock exchange. A 065 per contract fee applies for options trades with no minimum balances on most account types. Stay on top of it with the TD Ameritrade Mobile app.

Monitor the markets and your positions deposit funds with mobile check deposit catch up on the latest news and research or browse educational contentall from your mobile device. Note that state income taxes paid should be on your W-2. Taxes related to TD Ameritrade offers are your responsibility.

TD Ameritrade is a broker that offers an online platform for the trade of financial assets. Form 1040 Form 1040A and Form 1040EZ. TD Ameritrade free and safe download.

Investment accounts are not a deposit account or an obligation of HSA Bank and they may lose value. After several phone calls to reps it was clear they were confused as to how to complete the RMD requests. TD Ameritrade latest version.

Exchangelisted stocks ETFs and options. Td Ameritrade requires completion of a confusing form that appeared to be confusing even to Td reps. Read carefully before investing.

Or other taxing jurisdiction including that of TD. Because of the diversity of no load ETF funds TD Ameritrade is my top broker for people who want to consider tax loss harvesting on their own. Please read the prospectus and summary documents before investing.

Online broker for stock trading investing and planning. They are tax-advantaged investment plans registered with the federal government. Td Ameritrade provides the outstanding all-round experience which makes TD Ameritrade our top overall broker in.

Tax documents and the Secure Message Center. 1 The TD Easy Trade Tax-Free Savings Account refers to the TD Waterhouse Tax-Free Savings Account. Income and employment documents such as tax returns W-2s and 1099s.

Asset statements on bank retirement and brokerage accounts. The growth earned on investments within the TFSA whether in the form of capital gains interest or dividends is not taxed. So is the market.

The 15 minute time frame applies to normal situations and may not reflect the time needed for all users to read all disclosure documents which should be done. The Toronto-Dominion Bank TD or we has offered the Autocallable Contingent Interest Barrier Notes the Notes linked to the least performing of the shares of the iShares Russell 2000 ETF the shares of the Invesco QQQ Trust SM Series 1 and the shares of the SPDR SP 500 ETF Trust each a Reference Asset and together the Reference Assets. And in some cases the amounts that would be on a 1099 are readily available from documents you already have.

Equity option trades at the published website commission schedules for retail accounts as of 1032019 for ETrade Fidelity Interactive Brokers Schwab and TD Ameritrade. Please consult with a tax advisor or the state department of revenue for more information. Pick the right one and it could make a big difference.

Overall we found that TDA offers a superior mobile trading experience in. Online trade commissions are 000 for US. 2 Commission comparison based on opening and closing online US.

According to the research of 2018 TD Ameritrade has 37520 Billion assets. TD Ameritrade has one of the largest research offerings among discount brokers which is an especially big differentiator now that most brokers including TD Ameritrade offer 0 trading commissions. And TD Ameritrade Clearing Inc members FINRASIPC are subsidiaries of The Charles Schwab Corporation.

Such that the mega-merger of TD Ameritrade and Schwab in particular two firms that in the past had very opposite approaches to technology and very different cultures has left many RIAs from those already at Schwab or especially TD Ameritrade to those looking to form an RIA and decide on a custodian or break away from a broker-dealer. Investment accounts are not FDIC insured and they are not bank guaranteed. Most companies also allow you to check your accounts and tax documents online.

Federal income tax laws to an investment in the Notes as well as any tax consequences of the purchase beneficial ownership and disposition of the Notes arising under the laws of any state local non-US. Remember TD Ameritrade also offers 0 commission stock ETF and options trades. These documents are a crucial part of any benefit program offered by employer groups as they communicate the plan benefits and how each plan operates.

TD Ameritrade Mobile has 45 stars from 91000 reviews and thinkorswim has a 47-star rating from some 242000 reviews. Funds are available to meet customer claims up to a ceiling of USD500000 including a maximum of USD250000 for cash claims. TD Ameritrade Institutional PO BOX 650567 Dallas TX 75265-0567 TD Ameritrade Institutional Division of TD Ameritrade Inc.

The Employee Retirement Income Security Act ERISA requires employers who offer welfare benefit plans to create these documents and provide them to employees.

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

How To Read Your Brokerage 1099 Tax Form Youtube

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

March Exploiting Sector Etf Seasonality Patterns For Best Stock Gains Seeking Alpha Best Stocks Stock Trading Investing

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions